Paycheck Protection Program Update: Loan Forgiveness and Non-Recourse

Since the enactment of the CARES Act on March 27, the U.S. Treasury has issued guidance interpreting the Paycheck Protection Program (“PPP”) under the Act. It published an Information Sheet, which provides that the interest rate on PPP loans will be a fixed rate of 1% (the initial PPP Borrower Information sheet stated an interest rate of 0.5%). The CARES Act itself simply states that the interest rate cannot exceed 4.0%, so this is certainly welcome news.

Additionally, it sets the maturity on such loans (for any amount not forgiven) at two (2) years. Again, the CARES Act simply states that the maturity cannot exceed 10 years after the application for forgiveness, so this is less advantageous, but at least we have clarity on this point.

Late last night, the SBA released the Interim Final Rule for the PPP which provided clarification on a few key points and requested public comments within the next 30 days. One key clarification was confirmation that the program will be “first come, first served” - although the CARES Act leaves open the potential for approving additional funds.

A significant part of the guidance was the requirement that borrowers attest to and be able to prove economic hardship from the impact of COVID-19.

Finally, an updated PPP loan application has been released, although lenders may require information in addition to what is included in the application.

Starting April 3, 2020, eligible small businesses and sole proprietorships can begin to apply for PPP loans to cover their payroll and other certain expenses through existing SBA lenders.

If you are interested in taking advantage of a PPP loan, we recommend that you confer with counsel to determine eligibility and contact an SBA eligible lender as soon as possible. Working with a lender that your business already has a relationship with may help to streamline the process.

The Paycheck Protection Program differs from traditional SBA loans in a few ways; however, the most significant benefit of a PPP loan is the potential to apply for loan forgiveness if the loan is used for certain specified purposes in accordance with the Act. While the Act allows businesses to use the funds for a variety of purposes, business should take caution to only use the borrowed funds for expenses that are eligible for forgiveness under the Act (as further explained below).

Additionally, in the Interim Final Rule, the SBA provided that not more than 25% of the loan forgiveness amount may be attributable to non-payroll costs. Meaning, for the total principal amount of the loan to be forgiven, at least 75% of the loan proceeds need to be used for payroll costs (which is defined below).

With consideration to the foregoing requirements, borrowers will be eligible for forgiveness of indebtedness on a covered loan in an amount equal to the sum of the following costs incurred and payments made during the 8-week period following the origination of the loan (the “covered period”):

- Payroll costs, which is defined under the Act as:

- The sum of payments of any compensation with respect to employees that is a:

- Salary, wage, commission, or similar compensation (not in excess of an annualized salary of $100,000); [NOTE: The Interim Final Rule confirmed that while the salary limit per employee is $100,000, health insurance, benefits and state taxes on payroll over that amount will still be included. The Interim Final Rule also confirmed that payroll costs may not include payment to independent contractors because independent contractors are eligible to apply for a PPP loan as well.]

- Payment of cash tip or equivalent;

- Payment for vacation, parental, family, medical, or sick leave;

- Payment required for the provisions of group health care benefits, including insurance premiums;

- Payment of any retirement benefit; or

- Payment of state or local tax assessed on the compensation of employees; and

- The sum of payments of any compensation to or income of a sole proprietor or independent contractor that is a wage, commission, income, net earnings from self-employment, or similar compensation not in excess of $100,000 in 1 year, as prorated for the covered period;

- Any payment of interest on a mortgage obligation which was incurred before 2/15/20 (such payments shall not include any prepayment of or payment of principal on such mortgage obligation);

- Any payment on a rent obligation pursuant to a leasing agreement in force before 2/15/20; and

- Covered utility payments, which means payment for a service for the distribution of electricity, gas, water, transportation, telephone, or internet access for which service began before 2/15/20.

For ease, the forgoing expenses listed in (i) – (iv) will be referred to as the “Forgivable Expenses”.

It is important to note that both the Act and the application require borrowers to certify that loan proceeds will only be used to pay Forgivable Expenses, at the risk of being pursued for criminal fraud charges. If you are uncertain about whether a certain expense is a Forgivable Expense, please contact your attorney for guidance.

When applying for forgiveness, borrowers will be required to provide documentation showing payment of Forgivable Expenses, as explained below. We recommend depositing any funds received through a PPP loan into an account segregated from other operational accounts, which will provide additional evidence of compliance. If for any reason you cannot open a new account for this purpose, we encourage you to deposit the proceeds into your company’s payroll account.

In addition to using funds only to pay Forgivable Expenses, to achieve maximum loan forgiveness, an employer must maintain its number of employees and certain compensation levels.

How Reductions in Employees Will Affect the Amount Eligible for Forgiveness

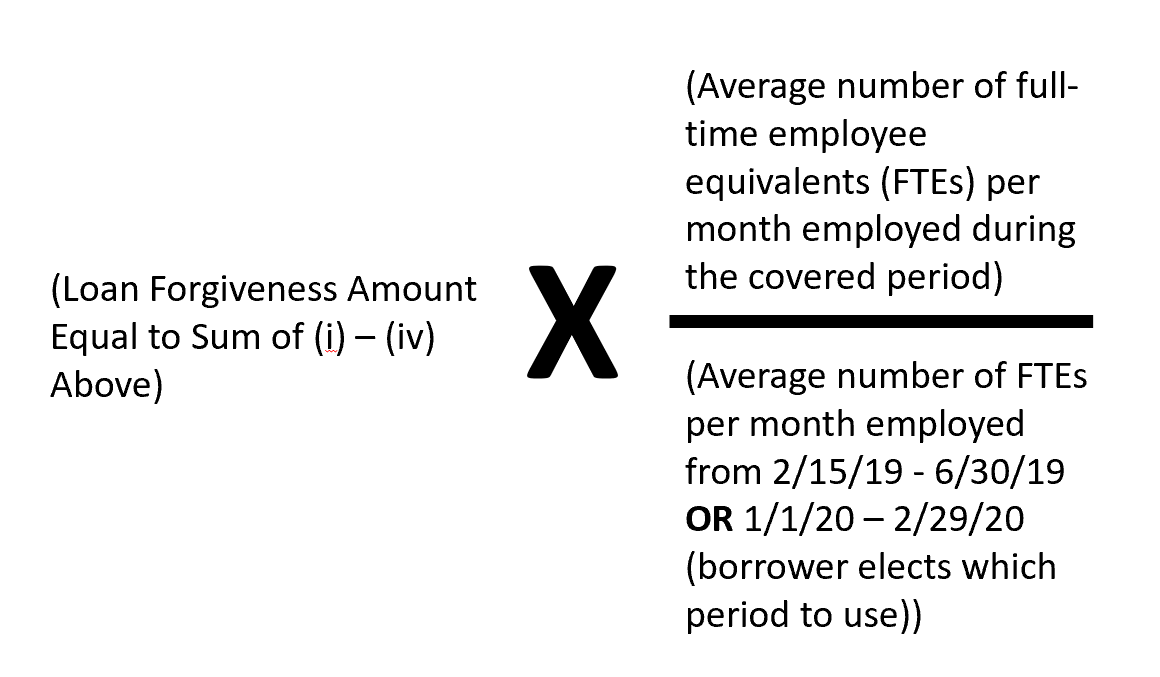

The amount of the loan eligible for forgiveness will be reduced if there is a reduction in workforce, as depicted by the following formula:

Any employers who have reduced the number of FTEs between 2/15/20 and 4/26/20 shall have until 6/30/2020 to re-hire such laid-off employees and avoid application of the reduction associated with a decrease of FTEs during the covered period. The “average number of FTEs” for purposes of the formula above will be calculated by the average number of FTEs during each payroll period in a month.

The term “full-time equivalent employee” is not defined in the Small Business Act nor is it defined in the CARES Act. Further guidance from the SBA is needed regarding what standard will be used.

How Reduction to Compensation Will Affect the Amount Eligible for Forgiveness

The total amount forgiven will be reduced if there is a reduction in excess of 25% to an employee’s salary during the covered period. Under this specific provision, the term “employee” is “any employee who did not receive, during any single pay period during 2019, wages or salary at an annualized rate of pay in an amount of more than $100,000.” Therefore, a reduction in the salary of an employee who makes more than $100,000 annually will not cause a reduction in the forgiveness amount, regardless of whether such reduction is in excess of 25%.

Additionally, eligible recipients with tipped employees may receive forgiveness for additional wages paid to those employees.

This reduction will be looked at on an individual employee basis. Any reduction to employee salaries during the covered period in excess of 25% of the total salary or wages paid to the employee in the most recent full quarter before the covered period will result in a dollar-for-dollar reduction (for the amount in excess of 25%) in the amount eligible for forgiveness.

Any employers who have reduced employee salaries between 2/15/20 and 4/26/20 will have until 6/30/2020 to restore compensation in order to avoid a reduction in the amount eligible for forgiveness.

Application for Loan Forgiveness

Eligible recipients seeking loan forgiveness must submit to their servicing lender an application, which must include:

- Documentation verifying the number of FTEs on payroll and pay rates for the covered period, including:

- payroll tax filings reported to the IRS; and

- State income, payroll, and unemployment insurance filings;

- Documentation, including cancelled checks, payment receipts, transcripts of accounts, or other documents verifying payments on covered mortgage, lease or utility payments;

- A certification from a representative of the eligible recipient certifying that:

- the documentation provided is true and correct

- the amount for which forgiveness is requested was used to retain employees, pay interest on covered mortgage payments, make payments on covered rent obligations, or make covered utility payments; and

- Any other documentation the SBA determines necessary

No eligible recipient will receive forgiveness without the proper documentation.

While the forgiven funds are considered canceled debt, the CARES Act specifically provides that such funds are not to be included as gross income for tax purposes. Lenders are required to issue a forgiveness decision no later than 60 days after the date on which the lender receives an application for forgiveness from the borrower.

Potential SBA Recourse on Amount Not Forgiven

In the event a borrower fails to repay any loan amount, and the lender receives payment under the SBA guarantee, the SBA will have a claim against the business (a claim by subrogation). Therefore, generally, the SBA “shall have no recourse against any individual shareholder, member, or partner of an eligible recipient of a covered loan for nonpayment of a covered loan…” However, the SBA may pursue such shareholder, member, or partner who uses the covered loan proceeds for improper purposes.

As stated above, borrowers will be required to certify that the loan will only be used for Forgivable Expenses. It is important to note here that the Allowable Uses under the Act are more expansive than Forgivable Expenses. We will await further guidance on this issue in any revised and/or additional regulations.

One item that has been clarified in the updated application is the effect of foreign ownership on eligibility. The initial form of PPP loan application contained a 20% foreign ownership bright-line test. This portion of the application seemed to imply that an application to the PPP will be denied if any owner of 20% or more of the applying business is not either: (i) a U.S. Citizen, or ii) a Lawful Permanent Resident. This bright-line test has been removed and the focus has been shifted toward including only those employees who primarily reside in the United States in an applicant’s payroll calculations.

The Interim Final Rule states that the SBA intends to promptly issue additional guidance regarding the applicability of affiliation rules to PPP Loans. The regulations surrounding the CARES Act are fluid and we will continue to work to keep you updated as new information becomes available. If you have specific questions on PPP loans, you should contact one of us or your attorney for guidance.

Ultimately, borrowers should use caution to avoid losing forgiveness eligibility and incurring penalties arising out of misuse of PPP loan proceeds.

This article is for informational purposes only and does not provide legal advice. Please do not act or refrain from acting based on anything you read here. Please review the full disclaimer for more information. Relying on the information provided in this article or communicating with Lowndes through our website does not create an attorney/client relationship.